Should You Buy a Fixer-Upper? What You Need to Consider

28 November 2024

So, you’re house hunting, and you’ve come across a fixer-upper that seems to scream potential—maybe it’s that charming Victorian house with peeling paint or the mid-century modern gem with the avocado-green kitchen straight out of a ‘70s time capsule. The price tag looks tempting, but here’s the big question: should you buy a fixer-upper? It’s a decision that can be exciting, nerve-wracking, and downright complicated. Let’s break it all down, step by step.

What Exactly Is a Fixer-Upper?

Before we dive in, let’s just clarify what we’re talking about here. A fixer-upper is essentially a property in need of some TLC (tender loving care). It might be a house where the roof leaks, the bathrooms are outdated, or the floors are more scratched than your cat’s favorite scratching post.Fixer-uppers come in all shapes and sizes. Some just need cosmetic updates, like a fresh coat of paint or new cabinets. Others, well, they may require extensive renovations—think plumbing overhauls, rewiring, or, in extreme cases, tearing walls down to the studs.

The allure? Lower upfront costs and the potential to customize the property to your exact tastes. But let’s be real—this isn’t HGTV. It’s important to weigh the pros and cons before diving in headfirst.

The Upsides of Buying a Fixer-Upper

1. Lower Purchase Price

Let’s get the obvious out of the way—fixer-uppers are usually cheaper than move-in-ready homes. If you’re working within a tighter budget, this can make homeownership more attainable. In some cases, you might even snag a fixer-upper in a desirable neighborhood that would have otherwise been out of reach.But here’s the kicker: the money you save upfront may end up being poured into renovations. So, lower purchase price? Yes. No financial headaches? Not guaranteed.

2. Room for Creativity

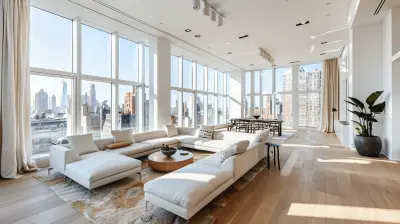

Do you love watching home improvement shows and imagining what you’d do differently? Buying a fixer-upper gives you the opportunity to channel your inner designer. Want an open-concept kitchen? Knock down a wall. Hate the carpet? Tear it out and replace it with gleaming hardwood.Think of it like a blank canvas. You get to make the house uniquely yours—without having to settle for someone else’s choices.

3. Building Equity Over Time

Here’s a sneaky little perk: sweat equity. When you improve a fixer-upper, its value goes up. If you buy low and renovate smartly, you could end up with a home worth far more than what you originally paid. This is particularly appealing if you’re looking at the property as an investment.For example, let’s say you buy a fixer-upper for $200,000, spend $50,000 on renovations, and end up with a home appraised at $300,000. That’s $50,000 in equity you just built. Not bad, right?

The Downsides of Buying a Fixer-Upper

1. Renovation Costs Can Balloon

If you’ve ever done a home project before, you know how things rarely go as planned. That “small” bathroom upgrade? Suddenly, you discover water damage, and now you’re dealing with mold remediation. Cha-ching!The truth is, renovations often cost more than you initially estimate. According to HomeAdvisor, the average home renovation can range from $15,000 to $200,000, depending on the scope. And while we all love a budget-friendly DIY moment, some projects—like electrical rewiring or roofing—require professional help, which comes with professional-level price tags.

2. It Takes Time and Energy

Sure, Chip and Joanna make it look fun on TV, but renovating a house is time-consuming. Even small projects can take weeks, while larger overhauls can stretch into months—or longer if you’re tackling it yourself.Think about whether you have the time, patience, and energy for this. Are you prepared to live in a construction zone? Can you juggle your full-time job and still find time to supervise contractors or hit the hardware store on weekends?

3. Unexpected Surprises

Let’s be honest—old houses (or even newer fixer-uppers) can be full of surprises. And not the good kind. We’re talking hidden structural issues, pest infestations, or outdated wiring that doesn’t meet modern codes.The worst part? These issues might not show up during a standard home inspection. So, budgeting for contingencies is a must. Experts typically recommend setting aside 10-20% of your renovation budget for the unexpected.

Key Questions to Ask Yourself

Before committing to a fixer-upper, here are a few questions to ponder:1. Do You Have a Realistic Budget?

Be honest—can you afford the purchase price and the renovation costs? Don’t forget to include extras like permits, inspections, and temporary housing if you can’t live in the home during renovations.

2. Do You Have the Skills?

Are you a DIY pro, or is your experience limited to assembling Ikea furniture? If you’re handy, you can save a lot. If not, you’ll need to hire professionals, which adds to the cost.

3. Do You Have the Time?

Renovations can be a marathon, not a sprint. Are you okay with living in a less-than-perfect space for a while?

4. Can You Handle Stress?

Because, let’s face it, renovations can be stressful. Delays, budget overruns, and unforeseen problems—all of these can test your patience.

5. Is This a Good Investment?

Talk to a real estate agent or consultant before making a decision. They’ll help you evaluate whether the fixer-upper has good resale potential.

Tips for Success

If you decide a fixer-upper is for you, here are some tips to make the process smoother:1. Get a Thorough Home Inspection

A home inspector can help you identify major red flags before you commit. Think of it as your safety net.2. Budget Wisely

Set a clear renovation budget, then pad it by at least 10-20% for unexpected expenses. Trust me, you’ll thank yourself later.3. Prioritize Repairs

Focus on structural and safety issues first—things like the roof, foundation, and electrical systems. You can tackle cosmetic upgrades later.4. Hire the Right Professionals

If you’re not an expert in something, hire someone who is. It’s worth spending a little extra for quality work than cutting corners and paying for it later.5. Take It One Step at a Time

Rome wasn’t built in a day, and neither is your dream home. Focus on one project at a time to avoid feeling overwhelmed.Is Buying a Fixer-Upper Right for You?

At the end of the day, buying a fixer-upper isn’t for everyone. It’s not just about the money—it’s about your lifestyle, your skills, your patience, and your long-term goals.If you’re the type who loves a good challenge and sees potential where others see problems, a fixer-upper could be a rewarding journey. But if the thought of renovating makes you break out in hives, it’s probably better to stick to a move-in-ready home.

Remember: a house is more than just a financial investment—it’s where you’ll live your life. So, make sure it’s a decision you’ll feel good about in the long run.

all images in this post were generated using AI tools

Category:

Real Estate TipsAuthor:

Mateo Hines

Discussion

rate this article

16 comments

Siena Morris

“Buying a fixer-upper? Just remember, it’s not a DIY fantasy—more like a reality show with a budget. If you’re ready for chaos, coffee, and countless trips to Home Depot, dive in! Otherwise, swipe left and call a pro.”

February 10, 2025 at 9:02 PM

Mateo Hines

Great perspective! It's essential to weigh the reality of renovations against your time, budget, and skills. Knowing when to DIY and when to hire a pro can make all the difference.

Geneva Castillo

Buying a fixer-upper? Just remember: it's like adopting a puppy—super cute, lots of potential, but you'll definitely need to invest time, money, and maybe a few band-aids!

January 28, 2025 at 9:44 PM

Mateo Hines

Great analogy! Just like a puppy, a fixer-upper can bring joy and satisfaction, but be prepared for the commitment and costs involved.

Maddox McElroy

Buying a fixer-upper can be rewarding, but it's crucial to assess renovation costs, potential resale value, and your own commitment to the project. Thorough research and realistic budgeting will ensure a successful investment.

January 21, 2025 at 7:23 PM

Mateo Hines

Absolutely! Careful assessment and budgeting are essential for a successful fixer-upper investment. Thanks for highlighting that!

Daniel Lawson

Purchasing a fixer-upper can be an appealing option, offering potential for increased value and personal customization. However, prospective buyers must carefully assess renovation costs, market trends, and their own skill set. A thorough inspection and realistic budgeting are crucial to ensure that the investment aligns with long-term financial and lifestyle goals.

January 15, 2025 at 12:45 PM

Mateo Hines

Thank you for your insights! You're absolutely right—diligent assessment and realistic planning are key when considering a fixer-upper.

Ivory Chavez

Buying a fixer-upper can be rewarding, but carefully weigh renovation costs, potential challenges, and your long-term goals.

January 9, 2025 at 5:54 AM

Mateo Hines

Absolutely! Balancing renovation costs with your long-term vision is crucial for a successful fixer-upper investment.

Juniper McCoy

Transforming a fixer-upper into your dream home can be challenging but rewarding—embrace the journey and unleash potential!

January 6, 2025 at 9:18 PM

Mateo Hines

Absolutely! Embracing the challenges of a fixer-upper allows for personal creativity and can lead to a truly unique dream home.

Carly McNeely

Calculate costs, envision potential value.

January 3, 2025 at 5:49 AM

Mateo Hines

Absolutely! Assessing costs and envisioning the potential value are essential steps in deciding if a fixer-upper is worth the investment.

Lennox Coffey

Buying a fixer-upper can be like marrying a project: exciting at first, but will it spark joy or just headaches? Weigh the costs, your time, and potential resale value carefully—because the right renovation can turn a diamond in the rough into your dream home…or a never-ending renovation saga.

December 30, 2024 at 8:20 PM

Mateo Hines

Absolutely! A fixer-upper can be a rewarding journey if approached thoughtfully. Balance your enthusiasm with a realistic assessment of costs and time to ensure it’s a fulfilling project rather than a source of stress.

Tessa Cruz

Fixer-upper: adventure in disguise!

December 26, 2024 at 6:01 AM

Mateo Hines

Absolutely! A fixer-upper can be a rewarding journey, offering both challenges and unexpected joys along the way.

Calder Carr

Great article! Buying a fixer-upper can be a rewarding journey, but it’s essential to weigh the pros and cons carefully. Understanding the potential challenges and rewards can make all the difference in creating your dream home. Thanks for sharing!

December 23, 2024 at 7:35 PM

Mateo Hines

Thank you for your thoughtful comment! I'm glad you found the article helpful in navigating the fixer-upper journey. Happy renovating!

Lillian Larsen

Buying a fixer-upper can be a smart move if you're ready for the challenges. Consider your budget, time, and skills. Ensure you’re prepared for unexpected expenses and delays. If you love the project, it might just be worth it!

December 18, 2024 at 8:27 PM

Mateo Hines

Absolutely! A fixer-upper can be rewarding if you're well-prepared for the challenges it brings. Just be sure to assess your budget, time, and skills beforehand to make the most of your investment.

Pia Navarro

Buying a fixer-upper? Just remember: it's all fun and games until you realize 'character' means ancient plumbing and questionable wallpaper!

December 15, 2024 at 12:19 PM

Mateo Hines

Absolutely! Embracing a fixer-upper can be exciting, but it's crucial to be prepared for the hidden challenges that come with "character." A thorough inspection can help you navigate those surprises!

Samuel Martin

Choosing a fixer-upper can be both exciting and daunting. Remember to weigh your emotional and financial readiness before making such a commitment.

December 12, 2024 at 9:34 PM

Mateo Hines

Absolutely! Balancing excitement with careful consideration of your emotional and financial readiness is crucial when deciding on a fixer-upper.

Greta McGarvey

Buying a fixer-upper is not just an investment; it's a chance to create your dream home! Embrace the challenge, harness your creativity, and watch your vision come to life. The journey may be tough, but the rewards are immeasurable!

December 10, 2024 at 11:45 AM

Mateo Hines

Absolutely! A fixer-upper offers a unique opportunity to personalize your space and build equity. Embrace the journey for a rewarding home transformation!

John Conrad

Fixer-uppers: the ultimate DIY adventure or just a paint nightmare?

December 2, 2024 at 9:54 PM

Mateo Hines

It can be both! A fixer-upper offers a rewarding DIY adventure for those ready to embrace challenges, but it can quickly turn into a paint nightmare if you're unprepared for the demands of renovation.

Zevan McMillen

Evaluate costs and time before committing to a fixer-upper.

November 30, 2024 at 4:30 AM

Mateo Hines

Absolutely! Assessing costs and time is crucial to ensure you're making a wise investment and can realistically handle the project's demands.

MORE POSTS

Expert Tips on Writing a Hardship Letter for a Short Sale

Understanding Reverse Mortgage Scams

Maximizing Small Spaces: Interior Design Hacks for Cozy Homes

The Impact of Green Building Certifications on Property Value

The Role of the Condo Board: How It Affects Your Day-to-Day Living

Boosting Property Appeal With Minimalist Virtual Staging Techniques

The Psychology Behind Virtual Staging: Helping Buyers See Potential

Urban Green Spaces: Their Role in Real Estate Value and Growth

The Risk of Buying Real Estate in Scam-Prone Foreign Markets

How to Stay Connected with Nature While Living in a Condo