March 27, 2025 - 09:08

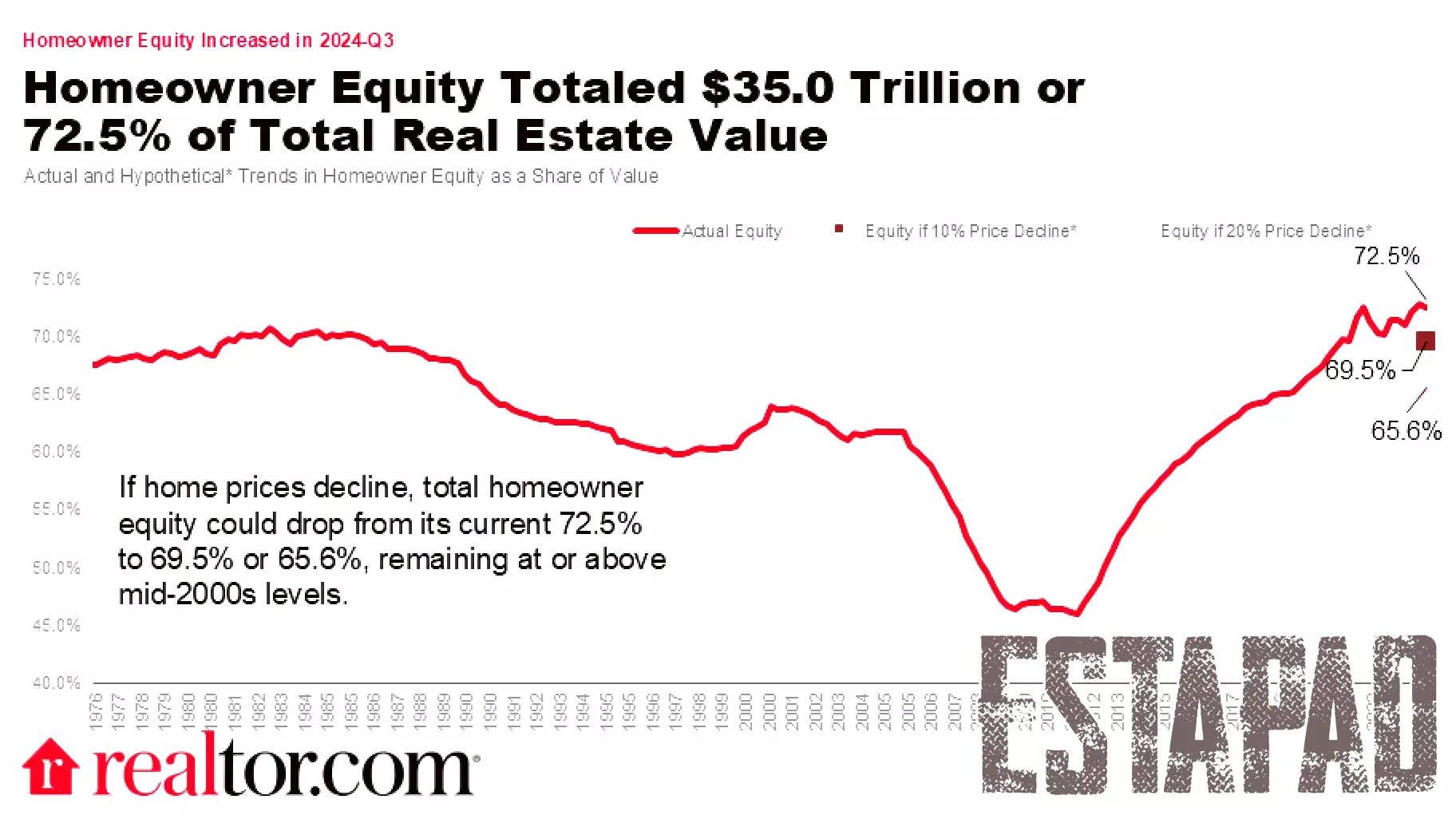

At the close of 2024, the Flow of Funds data from the Federal Reserve revealed a notable shift in the landscape of household real estate. The total value of owner-occupied real estate fell to $48.1 trillion, marking a retreat but still standing as the third highest value recorded in history. Despite this decline, home equity also experienced a decrease, settling at $34.7 trillion, which is similarly the third highest level observed.

In contrast, mortgage debt continued its upward trajectory, reaching a staggering record-high of $13.3 trillion. This increase in mortgage debt underscores the ongoing challenges faced by homeowners, as rising borrowing costs and economic uncertainties influence the real estate market. While the total value and equity have seen a decline, they remain significantly elevated compared to historical standards, reflecting the complexities of the current housing market dynamics. Homeowners and potential buyers alike will be closely monitoring these trends as they navigate the evolving landscape.