Why Income-Focused Investors Should Consider This $7 Billion Real Estate Stock

December 22, 2024 - 15:30

In a market saturated with high-profile investment options, one relatively unknown company is emerging as a compelling choice for income-minded investors: Agree Realty. With a market capitalization of approximately $7 billion, this real estate investment trust (REIT) offers a unique opportunity for those seeking consistent returns.

Firstly, Agree Realty boasts a robust portfolio of retail properties, strategically located across the United States. This diversification mitigates risk and enhances the potential for stable cash flow. The company focuses on acquiring properties leased to high-quality tenants, ensuring reliability in rental income.

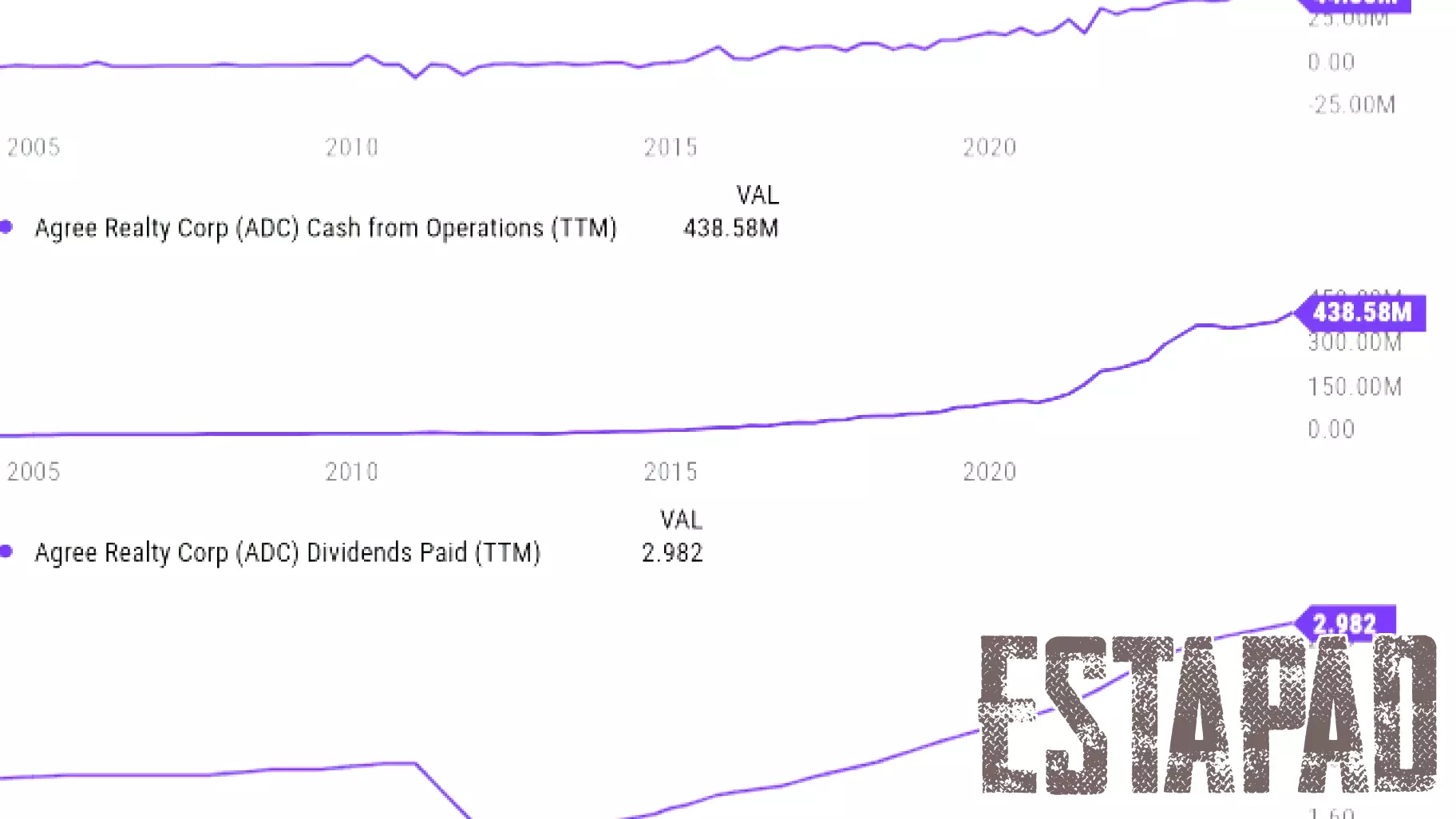

Secondly, the REIT has a strong track record of dividend payments, making it an attractive option for income-seeking investors. With a history of increasing its dividends, Agree Realty demonstrates a commitment to returning value to its shareholders.

Lastly, the current economic landscape favors the retail sector, particularly for essential goods and services. As consumer spending continues to rebound, Agree Realty is well-positioned to capitalize on this trend, potentially leading to significant growth in both revenue and stock value.

In summary, Agree Realty presents a promising investment opportunity for those looking to enhance their income portfolio.

MORE NEWS

March 13, 2026 - 06:00

Marquette senior gives Wisconsin’s real estate students a stage of their ownA new platform for aspiring real estate professionals has launched in Wisconsin, thanks to the initiative of a dedicated Marquette University student. Toni Coca, a senior, spearheaded the creation...

March 12, 2026 - 14:07

I exited one of the NYC area’s biggest real estate deals at 31. Here’s what I learnedAt 31, I successfully exited one of the New York City area`s largest real estate transactions. The experience provided a profound education in high-stakes dealmaking, timing, and personal...

March 11, 2026 - 18:29

Real Estate Fresh Finds for March 11, 2026A stunning Victorian residence built in 1907 has emerged as a premier offering in the current real estate market. Located on a prominent corner lot, the property at 4301 Kansas Ave NW presents a...

March 11, 2026 - 03:49

Fritz Kaegi: The property tax system is hard to understand. We’re working to change that.Cook County Assessor Fritz Kaegi has outlined both the significant progress and the ongoing challenges in reforming the county`s notoriously complex property tax system. In a recent commentary,...