Why Income-Focused Investors Should Consider This $7 Billion Real Estate Stock

December 22, 2024 - 15:30

In a market saturated with high-profile investment options, one relatively unknown company is emerging as a compelling choice for income-minded investors: Agree Realty. With a market capitalization of approximately $7 billion, this real estate investment trust (REIT) offers a unique opportunity for those seeking consistent returns.

Firstly, Agree Realty boasts a robust portfolio of retail properties, strategically located across the United States. This diversification mitigates risk and enhances the potential for stable cash flow. The company focuses on acquiring properties leased to high-quality tenants, ensuring reliability in rental income.

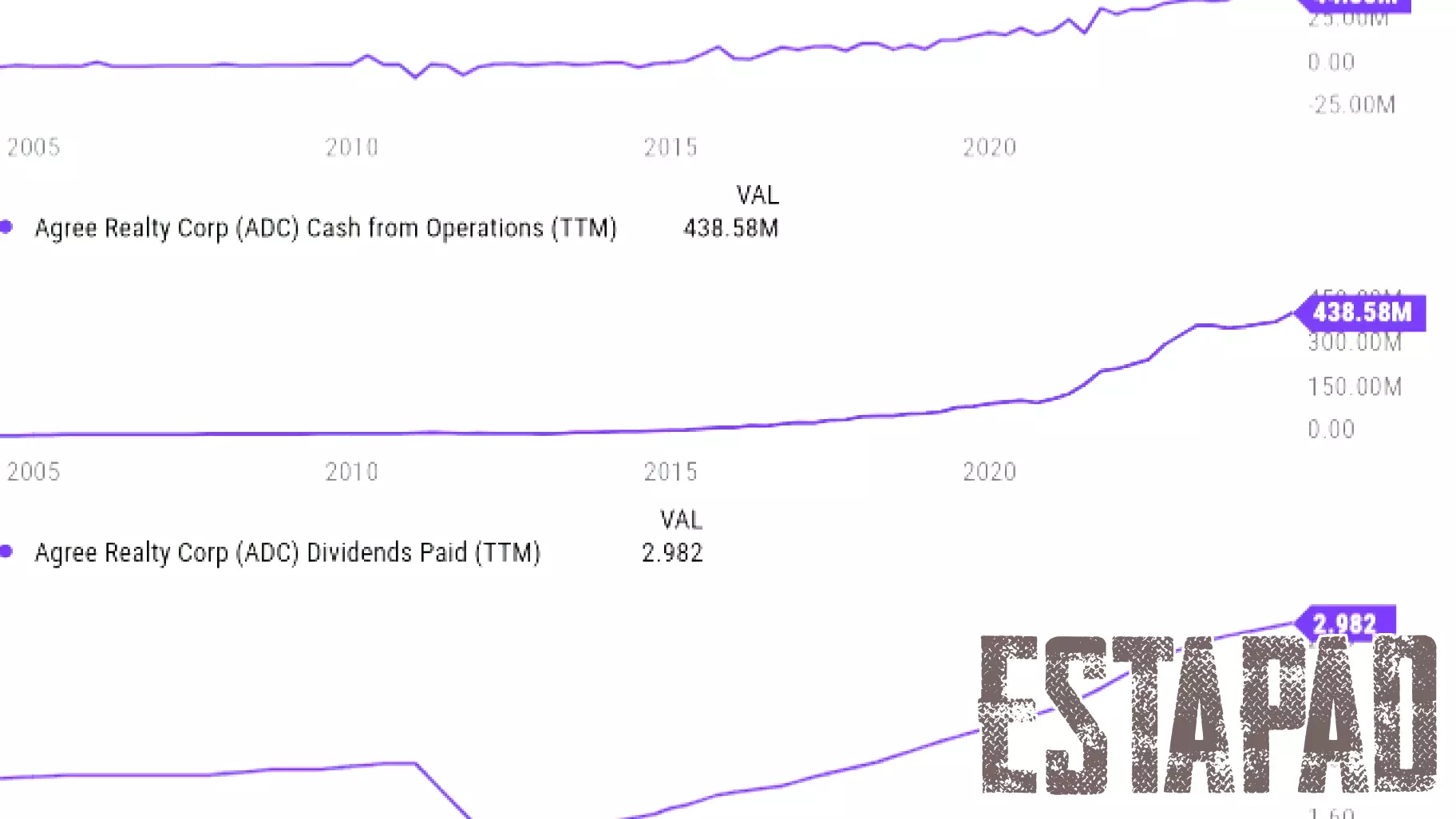

Secondly, the REIT has a strong track record of dividend payments, making it an attractive option for income-seeking investors. With a history of increasing its dividends, Agree Realty demonstrates a commitment to returning value to its shareholders.

Lastly, the current economic landscape favors the retail sector, particularly for essential goods and services. As consumer spending continues to rebound, Agree Realty is well-positioned to capitalize on this trend, potentially leading to significant growth in both revenue and stock value.

In summary, Agree Realty presents a promising investment opportunity for those looking to enhance their income portfolio.

MORE NEWS

March 10, 2026 - 00:16

Christopher Odell, Partner, TaxChristopher Odell provides comprehensive U.S. tax counsel to clients navigating intricate financial landscapes. His expertise is particularly focused on the formation of private funds and the...

March 9, 2026 - 03:14

The Federal Real Estate Maintenance Backlog Is Over $50 BillionA stark new assessment reveals the immense scale of the United States government`s crumbling infrastructure, with the cost to merely repair and maintain its vast federal buildings now exceeding $50...

March 8, 2026 - 04:42

Navigating Repairs and Renovations in Your Cooperative BuildingFor residents of cooperative housing, maintaining the building`s condition is a shared responsibility that directly impacts both quality of life and financial investment. While the co-op...

March 7, 2026 - 03:27

Funding Friday: Tom Steyer Makes a Real Estate PlayFormer presidential candidate and longtime climate-focused investor Tom Steyer is making a significant strategic move into the real estate sector. His firm, Galvanize Climate Solutions, has...